As profits earned by charity-owned businesses continue to skyrocket, critics say a centuries-old law that allows those companies to dodge income tax now needs to go.

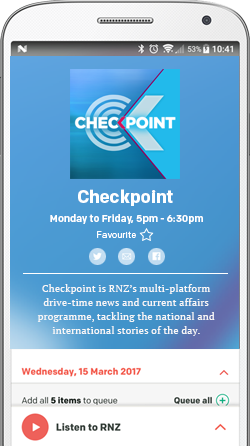

As Checkpoint's Nita Blake-Persen reports, you might be surprised how many products in your pantry are made by companies which don't have to pay tax.

Charity tax was an issue raised in the Tax Working Group's interim report, and with the group's final report due tomorrow, the government's being urged to make bold changes to bring church companies in line with the rest of the country.

Last year the total income of faith-based charities was more than $970 million.

Among the companies cashing in are Sanitarium, known for its products such as Weetbix and Marmite, which is owned by the Seventh Day Adventist church

The tax-free status applies to all registered charities, including charitable trusts, iwi groups and not-for-profits.

It is difficult to quantify how much money would be made from taxing those organisations. Cash can come from op-shops and sausage sizzles, to hospitals and schools, but here are some numbers to consider:

Businesses operated by the Seventh Day Adventists made more than $10 million in profit according to its last annual return, Trinity Lands, which is run by the Bretheren church, made nearly $19 million.

And the Society of Mary New Zealand Trust, which owns Mission Estate wines, made more than $2 million in profit.

All registered charities have to prove any profits are going towards their charitable purpose - those include providing education or housing, or advancing religion.

But the chairperson of the Interchurch Bureau, a group representing the business interests of around 30 New Zealand churches, Chris Bethwaite, said the tax-exemption was vital for the work churches did in communities across the country.

"Currently the government can't do enough or can't provide the services that are required to help communities and people in New Zealand. Churches across New Zealand do a lot of that work for the government - some having contracts.

"So yeah, you go and tax churches and it will have an impact on what the churches are able to do," he said.

But expert Michael Gousmett said proving that the money was being used for charitable purposes for increasingly tricky.

"A situation has developed in New Zealand where basically any organisation can decide that it wants to be a charity and run a business and pay no income tax," he said.

The government's tax working group has been looking at charities as part of its wide-ranging review into New Zealand's tax set-up.

It received more than 300 submissions about charities - many wanted the bodies stripped of tax-free status. Some said religious groups should not be considered charities, because they didn't deem 'furthering religion' to be a charitable activity.

Maria Robertson said the charitable sector in New Zealand was highly successful, but a separate review of the Charities Act was looking at whether things could be improved.

"The government is undertaking a review of the charities act, it's not going to look at the first principles around charitable purpose but it is looking at the constructs, the mechanisms, the facilities to make sure that it is fit for purpose."

Ms Robertson said the process for becoming a registered charity was rigorous - and charities had to work to maintain their registered status by providing thorough financial reports.

"We want to be sure that when people are donating their hard earned money and time, that it's going to where they thought it was going to go. We have between 35 and 40 people doing that, you're talking about a charity that has assets of over 40 billion dollars and a turnover each year of around 16 billion.

"So there's also a lot of self-regulation that happens in there," she said.

Mr Gousmett said that self-regulation wasn't good enough and he wants this government to fix what he sees as a major hole in New Zealand's tax policy.

But he said he often felt like the lone voice fighting against charities' tax-free status.

"It's up to kiwis and people running businesses that are disadvantaged by these organisations that should be speaking out, but I know from experience people are worried about the repercussions of doing that."

People are being encouraged to have their say at community meetings about the Charities Act review next month - they're taking place across the country at a range of venues - including churches.