People line up outside the closed Silicon Valley Bank (SVB) headquarters in Santa Clara, California, on 10 March 2023. Photo: AFP / Getty Images

US regulators have shut down a major bank and taken control of its customer deposits in the largest failure of a US bank since 2008.

Silicon Valley Bank, a key tech lender, was scrambling to raise money to plug a loss from the sale of assets affected by higher interest rates. Its troubles prompted a rush of customer withdrawals and sparked fears about the state of the banking sector.

New Zealand space company Rocket Lab, which is listed in the United States has $38 million, or 7.9 per cent, of its cash with the failed bank but says it is not facing a liquidity issue.

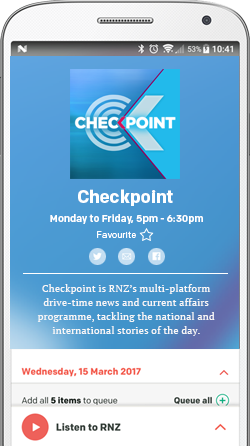

Kathryn talks to Mayra Rodríguez Valladares,a financial risk consultant who trains bankers and regulators.